BADI Bankmenedzser képzésünk kétnapos bankszimulációval zárul, ahol valóságközeli módon kell a csapatoknak dönteniük egymással versengő bankok menedzsmentjeként.

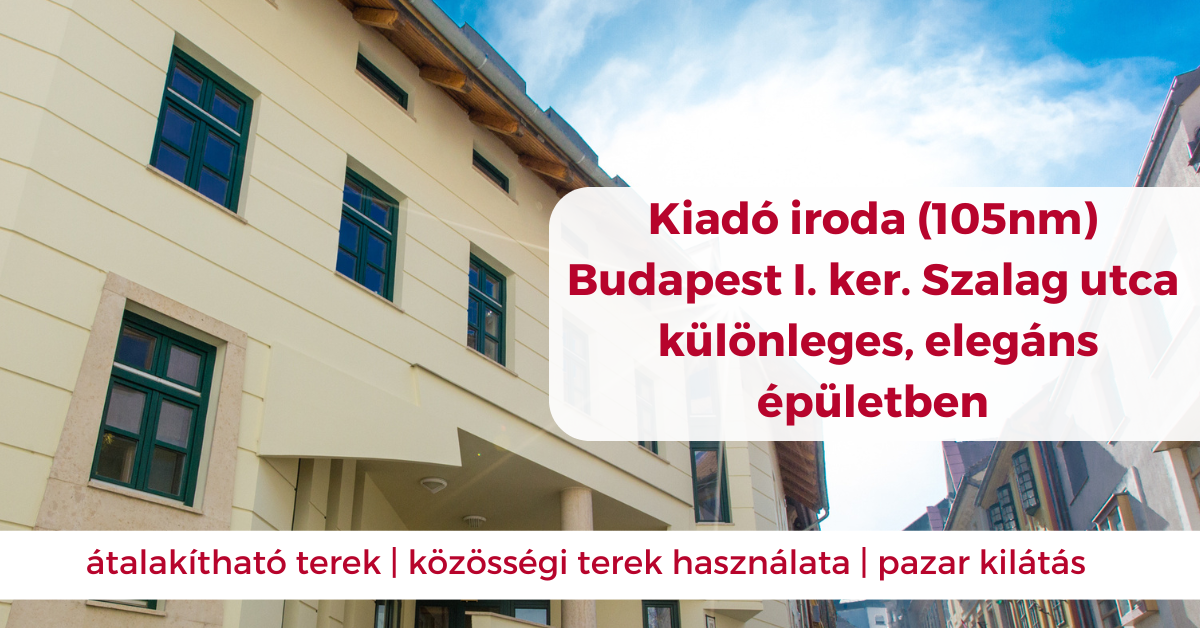

Kiadó iroda a Szalag utcában

- Budapest I. kerület

- 105nm terület

- átalakítható terek

- szabadon használható közösségi terek