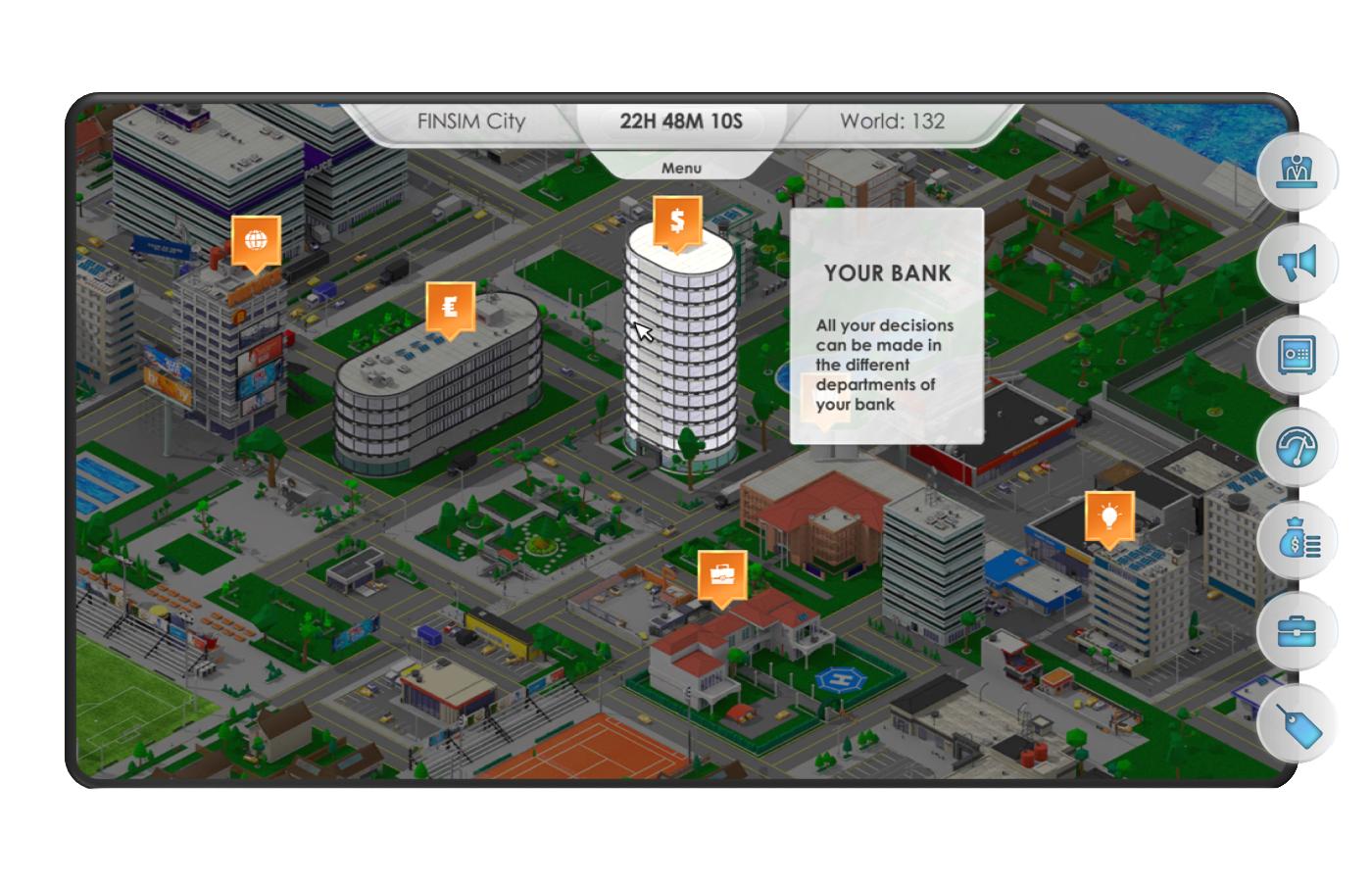

Finsim City – Bújjon a bankvezető bőrébe!

Ön a város egyik bankjának elnöke! A Bank teljesítménye – beleértve a stratégiai tervezést, az üzletfejlesztést, a kockázatkezelést, a treasury-t, a marketinget és még az értékesítési csatornákat is – csak az Ön döntéseitől függ. Kezdődjön a kihívás!

-

Banki szimulációs játék, amely a valós bankkezelést mutatja be

-

Alkalmas különféle közönségek számára a vezetőségtől a személyzetig

-

Rugalmas képzési összeállítás: 1 vagy 2 napos helyszíni, vagy távolról online

-

Valóságos banki döntések (árazás, fedezet, marketing stb.), a legújabb Basel 3 és IFRS 9 szabályok beépítve

-

Rugalmas modern technológia számos játékvariációval,

-

Több mint 50 bankkal játszottuk az elmúlt 10 évben

A program célja

Csapatépítés

A csoportokon belüli munkán, a csoportok közötti kommunikáción, a csoporton belüli konszenzuskeresésen keresztül.

A döntések hatásainak felmérése

A szimulált bank eredményeivel való szembesülésen, a döntések korlátainak és a versenytársakkal szembeni optimális lépések felmérésén keresztül.

A saját bankkal, stratégiájával való azonosulás

A saját bank piaci helyzetének bemutatásán, megbeszélésén, a saját felelősség tudatosításán keresztül.

A banküzem működésének megismerése

Valós banki helyzeteken, a szimulációs döntéseken és a döntéstámogató előadásokon, megbeszéléseken keresztül.

A FinSim City tréning kiválóan beilleszthető a banki karrier programokba illetve vezetőfejlesztő programokba, mert a munkatársak elméleti szakmai ismereteinek gyakorlatba való átültetését segíti elő és széles rálátást biztosít a bank egészének működésére és a menedzsment típusú döntésekre, ezáltal fejlesztve a vezetői készségeiket.

A tréning elősegíti a különböző területen dolgozó munkatársak közötti kommunikációt, valamint egymás területeinek jobb megismerését is, és hozzájárul ahhoz, hogy a résztvevők hatékonyan tudjanak együttműködni a döntéshozatali folyamat során.

A tréning során összesen 4 komplex döntést kell meghozniuk, melyek egy-egy negyedévre vonatkoznak. A hozott döntések eredményeiről riport készül, a helyes döntésekből tanulva, a hibákból okulva hozhatja meg a következő negyedév sikeres döntéseit.

A fókuszban:

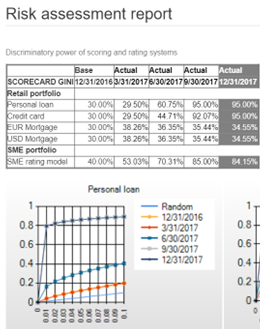

- Likviditás tervezés és kamatkockázat menedzsment

- Hitel- és betéti piacok

- Stratégiai tervezés versenyző piaci környezetben

- Hitelkockázat kezelés és szabályozói tőke

- Banki és termék szintű jövedelmezőség

És még több: emellett megismerhetik a kamat- és deviza swapok alkalmazását, amely a banki könyvi kamatkockázat és devizakockázat kezelését teszi lehetővé és elsajátíthatják az eszköz-forrás menedzsment és a banki likviditás tervezés alapjait is.

Az eredmény:

- vezetői skillset

- eredményes utánpótlásnevelés

- aktív csapatmunka

- empátia és hatékony együtt működés a társterületekkel

- bankvezetést a saját bőrén tapasztaló munkatársak

A „FinSim” szó nemzeti és EU-védjegyoltalom alatt áll, lajstromszáma:

a) a Szellemi Tulajdon Nemzeti Hivatalnál: 214 132,

b) az EUIPO-nál: 017937837.

Vegye fel velünk a kapcsolatot!

A Finsim City felkeltette érdeklődését? Csapatépítő tréning szakmai tartalommal? Kérjük keresse közvetlenül: